Do business owners need to pay Unemployment Insurance?

June 18, 2021 | Business | Employment

Let’s start with some background on unemployment insurance in Wisconsin. This article focuses on unemployment insurance from an employer’s perspective and specifically under Wisconsin state law. As such, we are not discussing the expanded unemployment provisions in the CARES Act, which primarily impact separated employees applying for unemployment benefits under more broad eligibility criteria. As the CARES Act provisions are federally funded, they have minimal impact on employers. In our experience, employers are not even notified as a party when a separated employee applies for benefits under the CARES Act provisions. Anyone curious about the CARES Act’s specifics is invited to read our analysis here, here, and here.

What is unemployment insurance?

Unemployment Insurance (“UI”, sometimes also referred to as Unemployment Compensation or UC) is a program that provides weekly wage replacement benefits for eligible individuals who have lost employment. In Wisconsin, UI is administered through the Department of Workforce Development (“DWD”). Check out KEW’s blog post regarding what type of conduct leading to termination may or may not make an employee ineligible for UI benefits, How badly does my employee have to mess up to be denied UI?.

Who is eligible for unemployment insurance?

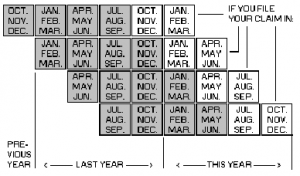

Claimants are eligible if they are able and available for work, the reason for separation from employment is not attributed to the individual’s own fault, and the individual has sufficient work history. Sufficient work history is calculated by looking at an individual’s base period. The base period is the first four of the five most recently completed calendar quarters, excluding the quarter in which the claim was filed. In certain limited situations, alternate base periods may be used. This chart is used by UI to determine a claimant’s base period:

For a thorough explanation as to how to calculate UI benefits, check out KEW’s article, How do probationary periods affect unemployment insurance?

How much will the employee’s weekly benefit rate be?

The weekly benefit rate is equal to 4% of wages paid by employers in the highest quarter. The minimum weekly benefit rate is $54, which requires earnings of $1,350 in the highest quarter, and the maximum weekly benefit rate is $370, which requires earnings of $9,250 in the highest quarter.

For how long can an individual receive UI?

Currently, in Wisconsin, an individual may receive UI for up to 26 weeks in any given benefit year.

How is unemployment insurance funded?

Unemployment insurance is funded by employers (not by all tax payers like some people think) through federal and state payroll taxes. Under the Wisconsin Unemployment Insurance law, employer payroll taxes are collected exclusively to fund the Unemployment Insurance Fund pursuant to a tax formula. UI benefits paid to a former employee are charged to the employer’s individual reserve fund account.The Federal Unemployment Tax (FUTA) partially funds the administrative costs of unemployment insurance.

What is an employer required to do under the Unemployment Insurance Law?

Employers in Wisconsin are required to open up an unemployment insurance account with the Wisconsin DWD and report all employees and wages to the DWD. Employers must also post a poster in the work place regarding unemployment insurance. Such posters can be found through the DWD. Employers designated as seasonal employers may be required to post an additional poster.

How much will an employer be liable in UI for any given employee?

If the employer was the only employer that paid wages to the employee during the employee’s base period, then that employer will be fully liable for the UI benefits collected by that employee. If, however, there were multiple employers, each employer’s liability will be prorated based on proportionate share of base period wages paid to the employee, provided that, if an employer’s proportionate share of wages paid was for less than 5% of the total, in most circumstances, the employer will not be required to contribute.

Will an employer be notified of an individual’s UI claim?

Yes. An employer who is potentially liable to pay UI benefits will receive a Form UCB-701 which shows the computation of possible benefits for the period for which the potential liability continues with respect to that individual.

In the event benefit payments are charged to an employer’s account, the employer will receive Form UCT-14384 notifying the employer of charges made to the employer’s account each week that benefits are paid to the former employee and charged to the employer’s account.

What if I disagree with a determination that a previous employee should receive UI benefits?

Determinations that an employee is eligible for UI benefits can be challenged by an employer. There are a variety of reasons for such a challenge, but common reasons for challenge include that the employee was terminated for substantial fault or that the employee quit. Whenever a former employee files a UI claim, the employer will receive a Separation Notice from the DWD, which can be used to dispute the reason for the termination.

Do I need to pay unemployment insurance for everyone in my company, including myself?

Generally, an employer must pay the UI payroll tax for all of its employees. A corporate officer exclusion is available for certain qualifying businesses and officers. Once the form is submitted, the corporate officers will not need to resubmit each year. Corporate officers may be excluded if all of the following conditions are met:

- The corporation had a taxable UI payroll of $500,000 or less for the previous year;

- The election to exclude was timely filed – this year, by March 31, 2017;

- The election covers all principle officers with 25% or more ownership interest in the company; and

- The corporation did not file an officer exclusion previously.

Opting out of unemployment insurance may not be financially advantageous for every company, and the decision to do so is best discussed with a tax professional.

For more information regarding Unemployment Insurance benefits, contact Attorneys Jessica M. Kramer, Leslie Elkins or Nicholas C. Watt.