Unemployment Insurance Questions Answered

March 25, 2020 | COVID | Employment | Events

Nearly 70,000 claims for unemployment insurance were filed in Wisconsin for the week beginning March 16, 2020, with 21,000 filing on Monday March 23, and the filings are expected to rise before they subside. The average weekly claims filed for weeks ending in 2020 before last week was 6,250. Before last week, the highest one-week total occurred in 2001 which was just under 50,000. So, suffice it to say, we are in unprecedented times.

The rise of unemployment insurance claims is no surprise considering the various orders that have come through in recent weeks, each more stringent than the last. The latest order requires all Wisconsin residents to remain “Safer at Home,” and allows only essential businesses to remain open. For a detailed analysis of that order, read Safer At Home Order Effective for the Next Month.

Along with filings for unemployment insurance come questions about the same, so the following is some background along with questions we have been getting.

What agency governs Unemployment Insurance?

Unemployment insurance is interesting in that it is a combination state and federal program. The programs are administered by the states, but each state must follow guidelines established by federal laws. The following are the standard federal requirements that must be adhered to:

- A claimant must be able, available and actively seeking work. (This is one of the requirements that has been softened in Wisconsin, as will be explained later)

- A claimant must be unemployed through no fault of the claimant’s own.

- A claimant must meet the state’s requirements for wages earned and time worked.

However, the federal government has softened unemployment insurance programs in light of the COVID-19 outbreak, by providing states the flexibility to pay benefits in the following situations:

- An employer temporarily shuts down due to COVID-19, in other words the employee is not technically laid off.

- An individual is quarantined due to COVID-19, but expects to return to work after the quarantine period ends.

- An individual leaves employment due to a risk of COVID-19 exposure or infection or to care for a family member.

Who is eligible to receive unemployment insurance?

Individuals are eligible for unemployment insurance if:

1) They are unemployed through no fault of their own. This means the employee did not quit, but rather was terminated. Also, that the employee was not terminated for “substantial fault” or “misconduct.”

2) They meet work and wage requirements. This means that the employee worked for a covered employer and earned enough wages to qualify for unemployment benefits.

How is unemployment insurance calculated?

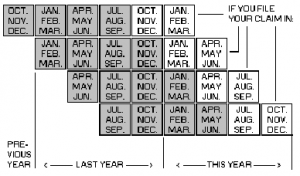

The weekly amount each employee receives (Weekly Benefit Rate or WBR) is determined from the employee’s Base Period. The Base Period is a set of four quarters which are determined by first disregarding the quarter in which the employee’s claim is being filed, and then looking at the first four of the previous five quarters.

For example, if an employee files a claim in March 2020 (2020 Q1), we disregard 2020 Q1, then look at the previous five quarters (Q4 2018, Q1-4 2019). The Base Period is the first four of those five quarters (Q4 2018, Q1 2019, Q2 2019, Q3 2019).

Next, we look at the highest earning quarter of the Base Period, which is referred to as the High Quarter. This High Quarter is used to determine the benefit rate.

The amount an employee receives is dependent on wages earned, with the maximum weekly rate for any employee at $370/week. In order to be eligible for this maximum amount, an employee needs to have earned $9,250 in the High Quarter.

Thee chart below is a helpful illustration of which quarters are used.

Keep in mind when looking at this graph and analyzing how wages are determined that oftentimes, an employee’s unemployment insurance benefits are based in whole or in part on work completed for a previous employer. For example, if an employee is terminated on March 25, 2020, from a job she began in July 2019, only one quarter of her work history from the now-ending job will be used in determining her benefit amount along with the previous three quarters which included either work from a previous job, or possibly no job at all.

For more examples and information about how unemployment insurance is calculated, please look to KEW’s article, “How do Probationary Periods Affect Unemployment Insurance?”

How much can an employee receive in Unemployment Insurance?

The amount that each employee receives during a week is referred to as the Weekly Benefit Rate. The Weekly Benefit Rate is calculated by taking 4% of the total High Quarter wages. The minimum Weekly Benefit Rate is $54, which is awarded from high quarter earnings of $1,350, and the maximum Weekly Benefit Rate is $370, which is awarded from high quarter earnings of $9,250 of greater. By way of example, $9,250 x .04 = $370.

What is the minimum amount of wages an employee needs to have earned to qualify for Unemployment Insurance?

A claimant must satisfy all of the following in order to receive unemployment insurance:

- High Quarter wages of at least $1,350

- The wages from the lowest three quarters of the Base Period need to equal at least four times that of the Weekly Benefit Rate when added together

- The total base period wages need to equal at least 35 times the Weekly Benefit Rate

- If an individual was paid in a prior benefit year that ended, the employee must have worked since the beginning of that year and earned at least eight times the Weekly Benefit Rate of that claim.

- A Benefit year starts when you file a new claim and it lasts 52 weeks.

What is a work search requirement?

Typically, in order to obtain benefits, employees are required to perform a specified number of searches each week. However, Governor Evers excepted this requirement during a public health emergency, which includes the coronavirus pandemic, in Emergency Order No. 7, issued on March 18, 2020, retroactive to March 12, 2020. The duration of the current lifted work requirement will last until the end of the public health emergency.

Note, despite not being required to search for work, claimants may still need to register with the Job Center of Wisconsin. This requirement may apply even for claimants that know they will be returning to work for an employer.

How long can employees receive Unemployment Insurance?

The maximum benefit amount is the lesser of 26 times the weekly benefit amount or 40% of the total base period wages from all covered employment. So, in most scenarios, UI benefits will be awarded for 26 weeks or until the individual returns to work.

Occasionally, and typically during time of high state unemployment, the time period in which Wisconsin residents can receive unemployment benefits may be extended. This is often done through federal funding, so we will watch federal relief legislation for such allowances in the future.

Can a business owner or self-employed individual receive unemployment benefits?

It depends. Wisconsin provides an “opt-out” that allows a business owner to decide not to pay unemployment insurance on the owner’s wages. If the owner elects this option, then the owner has opted out of receiving wages. If however, the owner has been paying taxes on themselves, then the owner would be eligible for unemployment benefits. In our experience, most self-employed small business owners do not pay unemployment insurance taxes on themselves.

If an employee quarantines, will the employee be eligible for unemployment insurance?

Let’s look at a few different scenarios:

- If an employer is deemed to be an Essential Business under Wisconsin’s Safer at Home order, and instructs its employees to report to work, but the employee decides to self-quarantine instead of reporting to work, the employee would not be eligible for UI benefits.

- If an employer required an employee to stay home, away from work and did not offer any telework options, then the employee would likely be eligible for UI benefits.

- If an employer ordered an employee to mandatory quarantine because of suspicion of having the coronavirus or having come into contact with an infected person, the employee might be eligible for unemployment benefits during the time of the quarantine as a temporary layoff assuming all other requirements are met.

If an employer must shut down due to the corona virus, will workers still be eligible to receive unemployment insurance?

Yes. In general, unemployment benefits are available to workers who have lost their job through no fault of their own, and an employer shut down due to the corona virus fits the bill.

If an employer eliminates an employee’s hours due to the coronavirus, will the employee still be eligible to receive unemployment insurance?

Yes. In general, unemployment benefits are available to workers who have lost their job, whether temporarily or permanently, through no fault of their own, and an employer eliminating an employee’s hours fits that requirement.

If an employee’s hours are reduced but not eliminated, will the employee be eligible for unemployment insurance?

Unemployment insurance benefits are available to workers who have become partially unemployed so long as the worker otherwise meets the requirements. In this situation, the Unemployment Insurance Division applies a formula to determine the amount of partial benefits.

What is Disaster Unemployment Insurance?

Disaster Unemployment Assistance (DUA) is a program that authorizes the President of the United States to provide benefit assistance to individuals unemployment due to a major disaster. This fund provides assistance to individuals who are unemployed due to the major disaster that do not otherwise qualify for regular unemployment insurance benefits.

As of March 25, 2020, the President has not declared a major disaster, and as such no additional DUA funds are available at this time.

If an employee receives unemployment insurance due to a coronavirus related business closure, will the employer’s unemployment taxes increase?

Most likely, yes. An employer’s tax rate increases when employees file for unemployment insurance.

What is the Work-Share Program?

The Work-Share Program allows a qualified employer to reduce the hours of work across a work unit. Workers with reduced hours can receive unemployment benefits that are pro-rated depending on by how much the work is reduced.

A Work-Share plan must include the greater of 20 employees or 10 percent of the employer’s work force. By way of example:

- If a company has 20 employees, the plan must include all employees

- If a company has 100 employees, the plan must include at least 20 employees

- If a company has 150 employees, the plan must include at least 30 employees

- Hours must be reduced evenly across the entire Work-Share Program, so that each worker’s hours are reduced by the same proportion.

- The hours reduced must be at least 10% but no more than 50% of the normal hours worked each week.

- Employees must be regularly employed by an employer

- Full time and part time employees may be part of the program

- Seasonal or temporary employees are excluded from the employee count and may not participate

- The employees must have been employed by the employer for at least three months on the date the Work-Share program begins

To participate in Work-Share, the employer needs to submit a plan to the DWD. Check out the Work-Share fact sheet to learn more.

Contact Kramer, Elkins & Watt, LLC with questions regarding how these regulations affect your business.